A research project conducted by MOBA and partners in 2022

content: • The context of the CSEE region • Structure of the project • Findings on the potential demand and supply • The partners

Recordning of the online presentation of the reserch report can be viewed here.

In Central and South-Eastern Europe (CSEE) more and more households are facing increasing housing unaffordability and are unable to attain an adequate home. In response to the lack of affordable housing, bottom-up initiatives have started exploring new ways of securing socially and environmentally just housing. A few public actors have also started to think about ways to develop new rental housing. However, these rental and cooperative housing initiatives are faced with the persistent doubt if their solutions are appropriate for the households in the region, on the one hand, and on the other, with the lack of adequate financial actors, instruments and investments.

Why is such research needed? The context of the CSEE region

Having identified this two main issues, the research project supported by Catalytic Capital Consortium Grant enabled us to:

- provide concrete evidence of the demand for sustainable community-led rental housing solutions,

- understand the existing scheme of financial actors and their instruments in the region and map out the potential actors for catalytic capital investment.

Structure of the project

The research included Bosnia and Herzegovina, Bulgaria, Croatia, Czechia, Hungary, North Macedonia, Serbia, Slovenia, but we pursued a deeper analysis and carried out representative surveys and expert interviews in capital cities of the four so-called “core countries” (Croatia, Hungary, Serbia, Slovenia). We also conducted expert interviews with international institutions with experience in financing affordable rental and cooperative housing projects.

Findings on the potential demand and supply for new housing solutions

The detailed results of our research are summarized in the following two reports: • Investor Report (download, 24 MB) • Full Research Report (download, 14 MB) Both are free for download.

THE CONTEXT

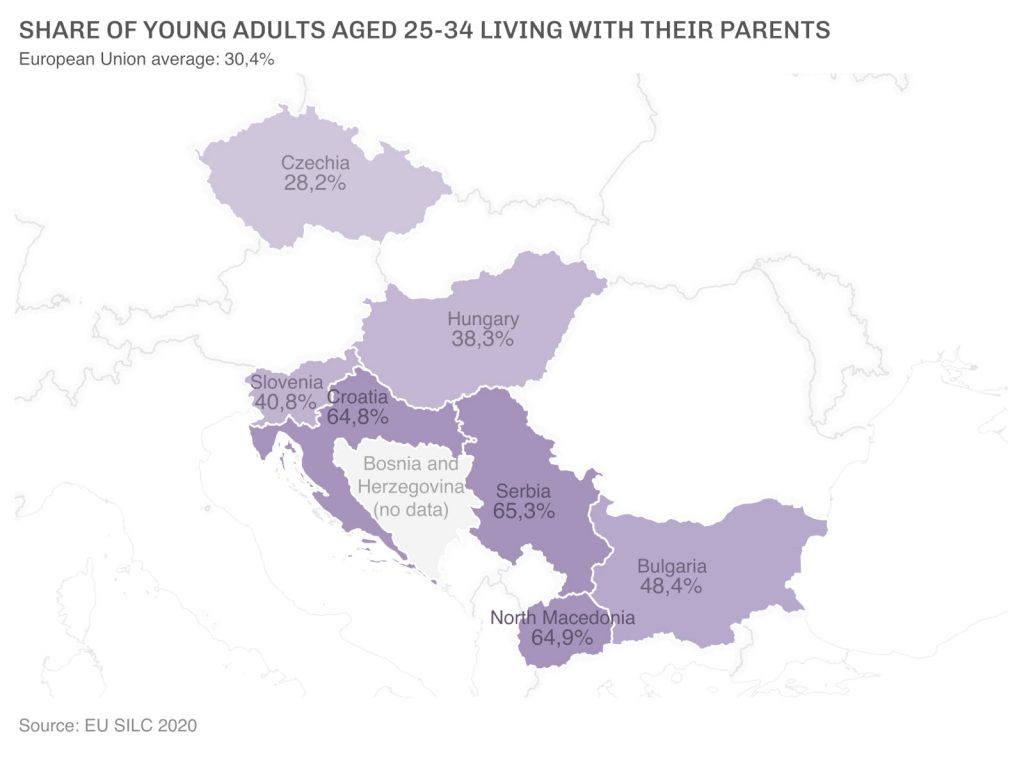

The political and economic turnover in the early 1990s propelled the region of Central and South-Eastern Europe (CSEE) from state socialism to a liberal market economy. Like most other areas of the economy, the housing sector underwent rapid privatization and marketization, and there has been very little public engagement ever since in the field of housing – except for programs supporting the middle classes’ access to homeownership. These factors have led to more profound housing-related problems than in other European countries.

Housing poverty affects 20-30% of the population in this region. Securing an adequate home is not only a hardship for the most marginal segments in these societies, but an everyday reality for diverse social groups. Housing quality and the energy efficiency of buildings is also critically low and needs to be addressed.

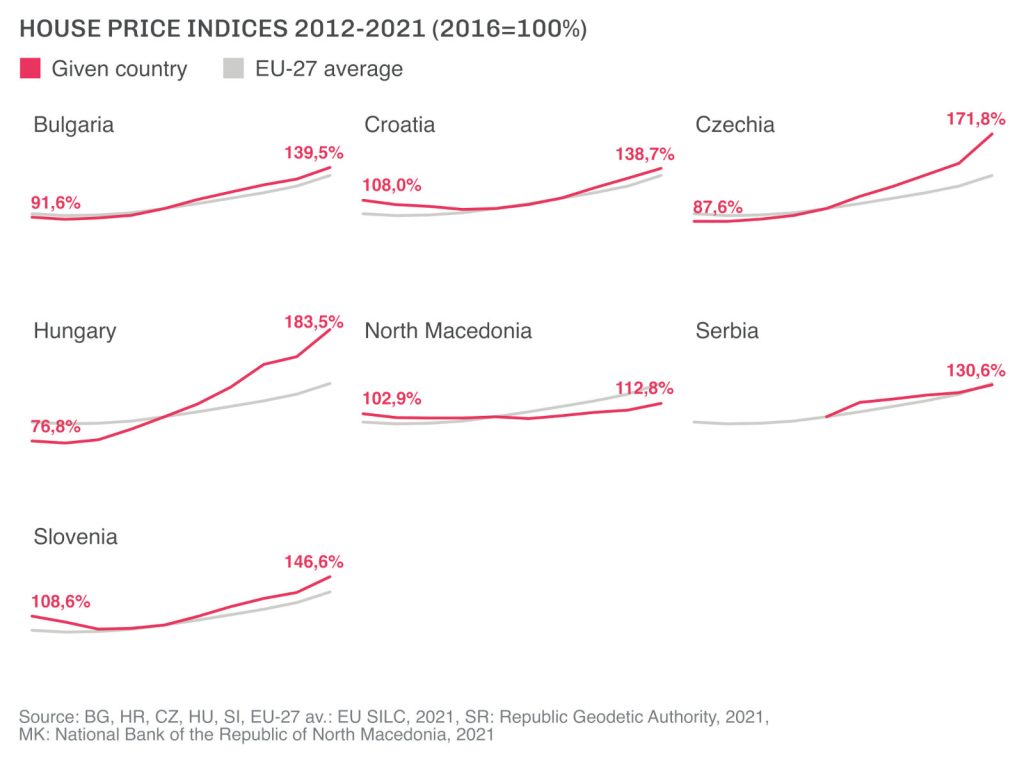

Since 2015 significant sale price and rent hikes on the residential market further escalated these problems. Some countries of the region experienced the highest increase of housing price indices compared to EU averages in the period between 2015 and 2022.

WHO ARE THE POTENTIAL INHABITANTS OF NEW AFFORDABLE RENTAL AND COOPERATIVE HOUSING PROJECTS?

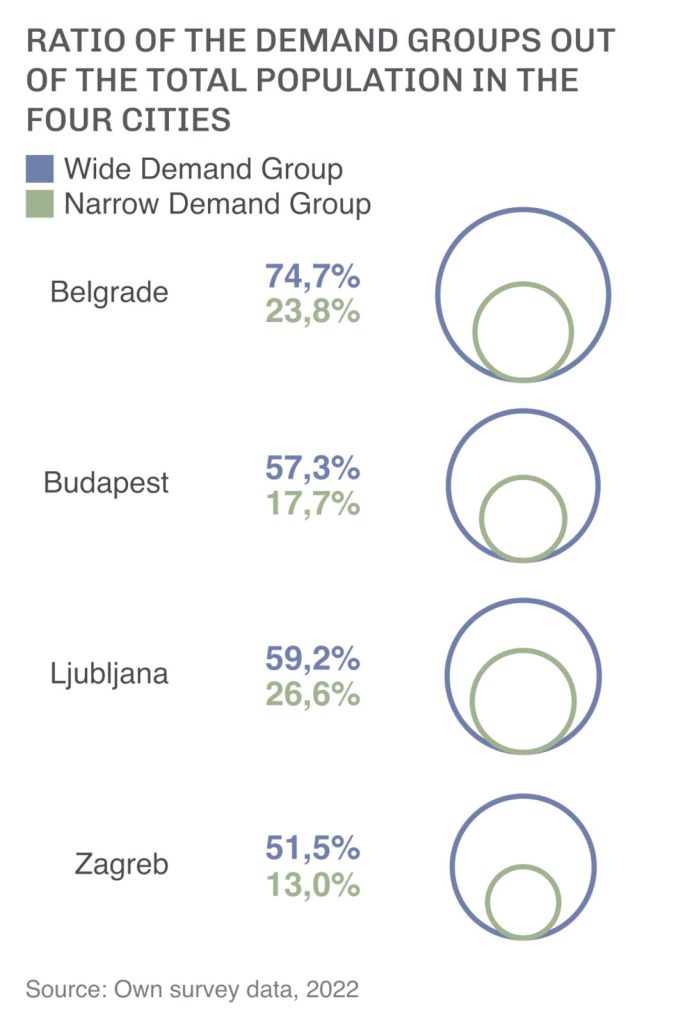

In our project we conducted a survey in Belgrade, Budapest, Ljubljana and Zagreb to identify the target groups for new rental and cooperative solutions.

- The results show that more than 50 % of respondents are either not satisfied or worried about their current housing situation (and/or they or one of the other members of the household want to move out), which indicates that it is not only the most vulnerable parts of society who are affected, but also the middle class.

- Within this large group, those who met material (above the lowest income groups) and subjective criteria (open to new rental-based solutions) were qualified as the narrow demand group for new housing models. This group presents between 13 and 26% of the population in the four chosen cities, which indicates the clear potential of developing such solutions.

Members of the demand group are typically younger, living in larger households, who are more likely to have children and have above median incomes. However, the relatively high income does not translate into greater satisfaction with housing or housing security. Despite their relatively high income, these households are still unable to solve their housing problems on the market and are more open to new rental alternatives.

>> For more data go to the Final Research Report (download, 14 MB)

IDENTIFYING THE HOUSING FINANCE GAP

We mapped currently existing housing finance products in all eight countries, and interviewed local financial actors in the four core countries of the research. This overview proved that there is a lack of appropriate financial products for rental or cooperative housing projects, and most actors also seem reluctant to enter this field, because of the costs and risks associated with developing new products. Available housing finance instruments to individuals are housing loans (mortgages), while for companies and organizations, the available instrument is typically a short-term (2-3 years) project loan for building projects where apartments are sold individually.

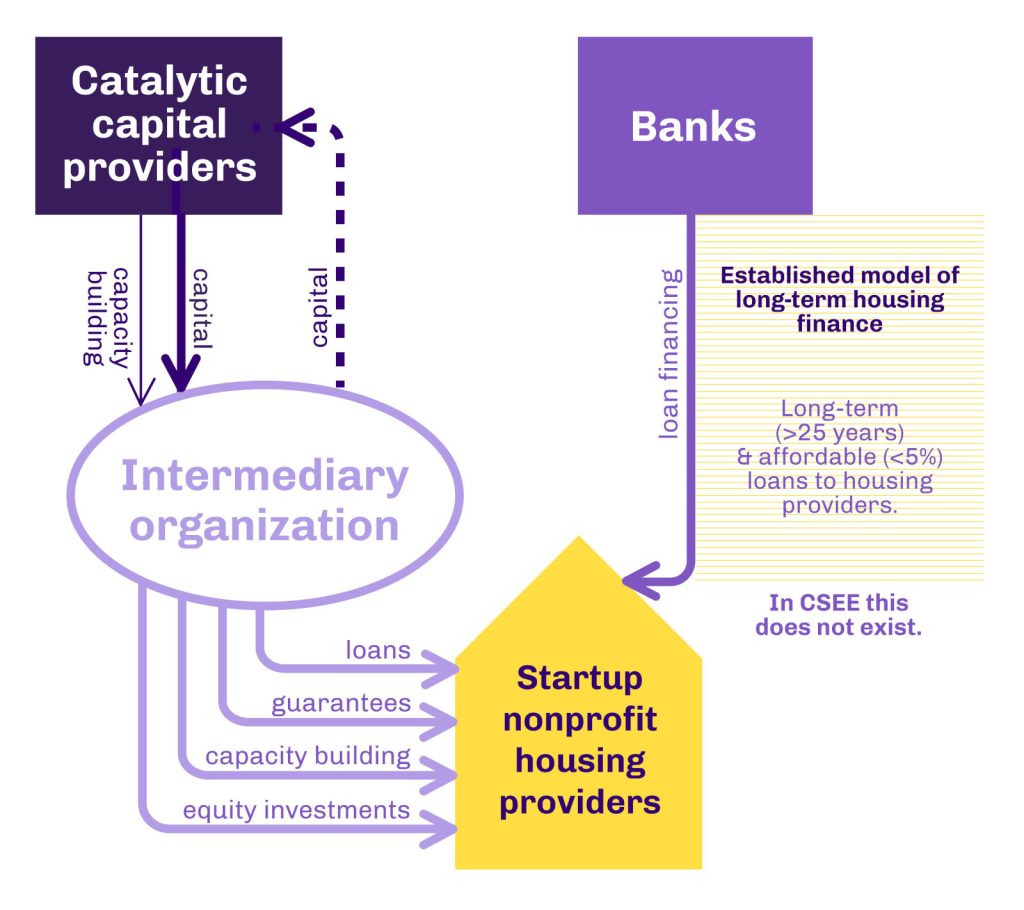

Housing experts agree that in order to have more stable and less volatile, less vulnerable housing markets, the rental housing sector would need to be developed. With current financial instruments this is not possible in most of the countries we investigated. Thus, the challenge that presents itself is how institutions and financial mechanisms allowing for rental housing can be developed in the region. In countries with a developed rental housing market, this is usually financed with long-term, affordable bank loans. Since in CSEE neither long-term loans to organizations, nor experienced rental and cooperative housing providers do not exist, different, catalyzing financial solutions need to be developed.

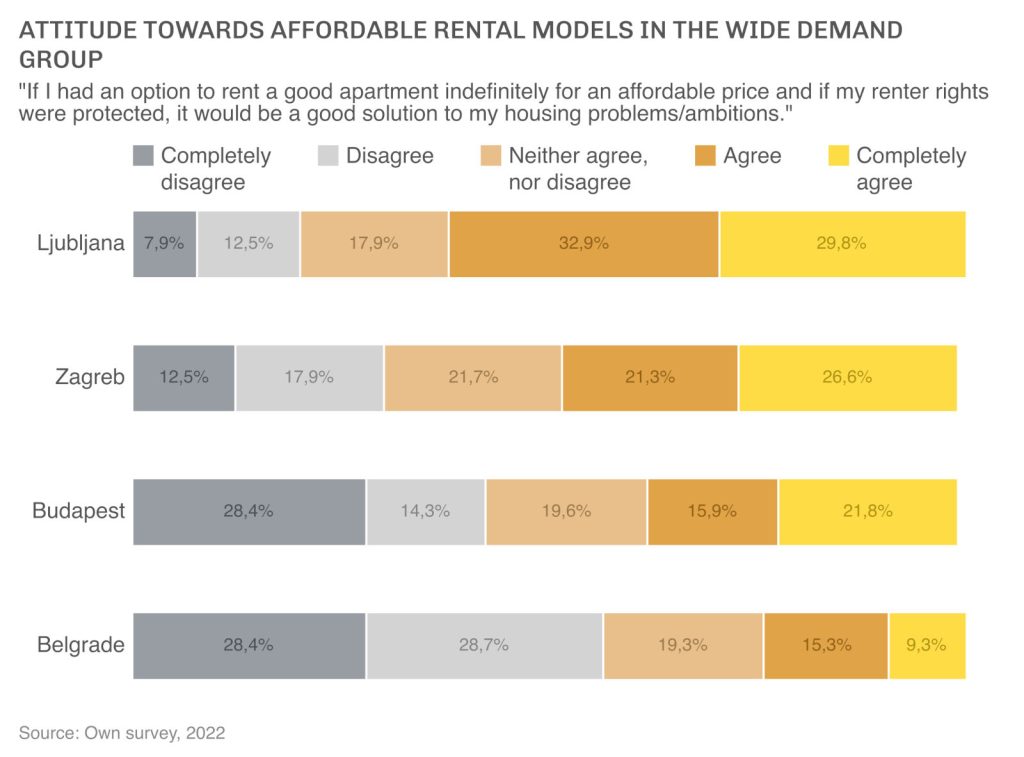

In the region there is a typical narrative of local decision makers and investors who claim that households prefer homeownership and are not open to alternative forms of tenure. With our survey results we can objectively disprove this myth, and households are actually interested in housing that is stable and affordable in the long-term. The results have also shown that many households are not able to take an individual loan (20-30% of the respondents who have already applied for a loan experienced some kind of difficulties in the process).

Altogether, a potential market for new rental and cooperative housing solutions exists, but its instruments still need to be developed.

>> For more data go to the Final Research Report (download, 14 MB)

DEVELOPING THIS MARKET THROUGH CATALYTIC CAPITAL INVESTMENT

The gap of missing long-term finance for rental and cooperative housing projects can be bridged with catalytic capital investment. This investment can kickstart the initial, capital intensive phase of starting such projects, and provide a proof of concept which will allow to engage longer-term, more conventional forms of finance. Thus, beyond enabling housing projects, this initial catalytic capital investment can also contribute to shifting the current limiting housing finance landscape in CSEE.

A further key to success is to have capacity building both on the scale of nonprofit housing providers and of intermediary organizations. The latter are necessary because of the difficulty of catalytic capital providers to engage directly with housing providers operating in different countries.

Thus, the research feeds into the broader ambition of MOBA Housing SCE, which is to become a regional financial intermediary for new rental-based and limited equity housing cooperatives in the CSEE region. The main financial instrument MOBA is developing for this purpose is the MOBA Housing Finance Accelerator, which works as a quasi-fund, collecting capital through donations, investment through shares, and potentially issuing bonds. The Accelerator can collect capital all across the “impact investment” spectrum and then offer the needed financial instruments to enable housing cooperative projects in the region.

The research gave MOBA the needed push to start serious fundraising for the Accelerator – aiming to raise one million euros by the end of 2023 and enable some of the first projects in the region!

>> For more information go to the Investor Report (download, 24 MB)

The partners

The project brought together seven partners with all the necessary knowledge and expertise to tackle the tasks at hand.

Four expert organizations from the field of housing, based in four different capital cities in the ESEE region:

- Periféria Policy and Research Centre in Budapest

- Ko gradi grad (Who Builds the City) in Belgrade

- Pravo na grad (Right to the City) in Zagreb

- Inštitut za Študije Stanovanj in prostora – IŠSP (Institute for Studies in Housing and Space) in Ljubljana.

In collaboration with three large networks:

- Zaduga za etično financiranje – ZEF (Cooperative for Ethical Finance) from Croatia – the largest cooperative of cooperatives in the region, with expertise in the design of innovative financial instruments

- European Cooperative Society MOBA Housing SCE (MOBA) – a regional network of bottom-up collaborative housing groups with the support of its associate members, the internationally recognized housing NGOs urbaMonde and World Habitat

- Habitat for Humanity’s office for Europe, Middle East and Africa (HFHI EMEA) – one of the most experienced international housing NGOs.

The project was supported by a grant from the MacArthur Foundation, the Omidyar Network and the Rockefeller Foundation through their support of the Catalytic Capital Consortium Grantmaking, a project of the New Venture Fund.