The first Call for Loan Requests of the MOBA Housing Development Fund

MOBA Housing SCE is calling its full member organisations to submit proposals for projects to be financed with the support of its MOBA Housing Development Fund.

The link to the Call for Loan Requests form can be found here. Proposals will be received until June 20, 2021, and reviewed by the Fund Committee. Decisions about the attribution of funds will be taken by June 30 and loans will be issued in July. A further Call for Loan Requests may be issued later in the year.

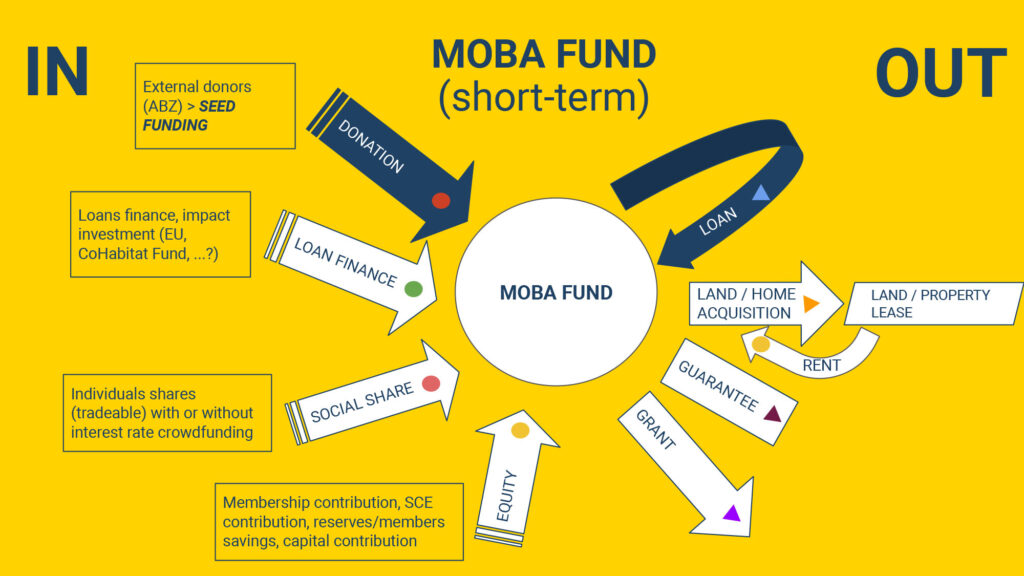

What is the MOBA Housing Development Fund?

The MOBA Housing Development Fund is being set up as part of the MOBA Housing SCE and thanks to a seed capital of 21,600 EUR provided by the cooperative ABZ in Zurich. Currently, in its pilot stage, it is intended to grow into the financial vehicle of MOBA, supporting the development of cooperative housing projects federated under MOBA.

Who is the Fund Committee?

The Fund Committee is composed of 1 representative of each MOBA (full) member – plus 1 representative of an associate member nominated to the Fund Committee as a facilitator (with no right to vote). The member(s) who submit an application cannot vote on their own proposal.

The Fund Committee is being constituted in parallel to the present Call for Loan Requests and approved by MOBA Housing SCE’s General Assembly (in mid-June 2021).

The Fund Committee is responsible for issuing the Call for Loan Requests (except for this first Call which is issued by the working group) and responsible for taking decisions on loan allocation and repayment conditions.

How does it work?

The present Call for Projects is a “test run” for the MOBA Housing Development Fund. In 2021, the MOBA Housing Development Fund will issue at least one loan to MOBA members with the aim of attributing the total amount of 18,000 EUR to its members in the course of 2021.

Types of loans, among others:

- Kick-start loan/door-opener for other financiers

- Bridge loan

- Renovation costs

- Land or house acquisition

The loan cannot be used to pay consultants, studies or human resources.

Eligibility criteria:

- To request a loan, one must be a full member of MOBA Housing SCE.

- The repayment capacity/financial solidity/risk will be assessed on the basis of the financial plan of the project.

- Priority will be given to projects with urgent financial needs and that have a high impact on the project lifecycle.

The definite criteria will be discussed and established by the Fund Committee.

Terms:

- The loans should have a duration of a maximum of 18 months

- The maximum amount you can request in this round is 18,000 euros. The Fund Committee may suggest reviewing the loan duration and amount.

- The loan is issued in euros; transfer costs and the currency exchange risk will be covered by the Fund’s reserve. To cover for the risk, the MOBA Housing Development Fund will keep a reserve of an additional 20% (3,600 EUR).

- The suggested repayment schedule is every 6 months via bank transfer, but members can propose a repayment schedule that better fits their project.

- The yearly (nominal) interest rate is 2.5% (interest on a 1,000 EUR loan = 25 euros per year).

A loan contract will be signed between MOBA Housing SCE and the MOBA member (applicant), in line with Croatian legislation.